Fintech is an abbreviation of financial technology, where industry start-ups take advantage of digital technology to transform the delivery of financial services. Businesses are investing in Fintech software while improving and automating their services. In 2019 EY’s global Fintech Adoption Index shows that more than 75% of consumers already used one or more industry platforms or applications. It seems that in the future, companies will introduce more technology in digital finance.

Today we are witnesses of the technology revolution, converting financial services delivery through software and mobile applications. We are living in a dynamic world, where time is more valuable than money for many people. These digital alterations create a sequence that constantly changes, influences industries and our daily lives.

The Internet was the start, altering our experience of how we read newspapers. Now cloud technology powers the circuit of a seamless banking experience. The speed and flexibility of the technology is an advantage for start-ups implementing fintech software solutions.

According to the data provided by Cisco Systems, the global cloud traffic is about to surpass 14,078 exabytes per year. Technological changes like these influence innovations and how users envision services. Continuous online evolution forces organisations to speed up digital transformation to survive. Statistics show that many realize the potential and necessity of implementing new technologies now, more than ever.

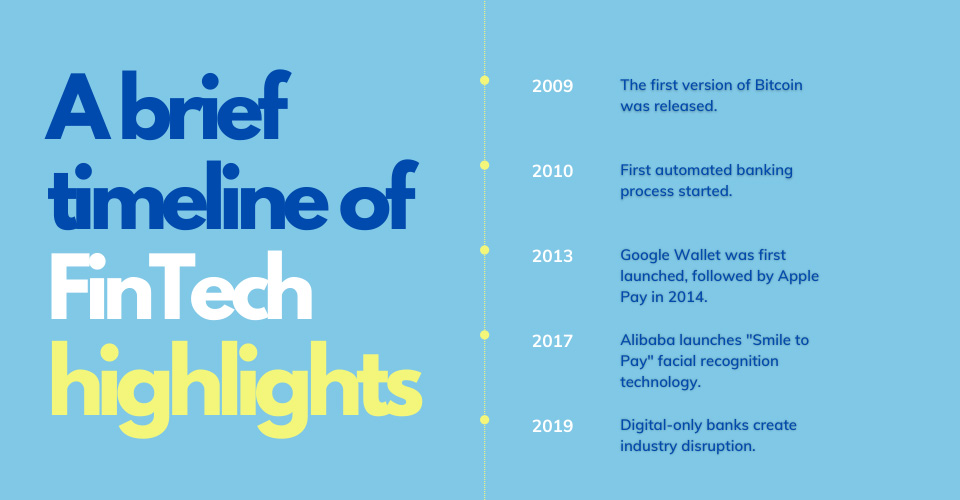

With previous barriers in business gone, the contrast between online and offline activity is slowly fading. At the start of a new banking era, digital services no longer support a physical business. Instead, start-ups are maximising the design and data to produce a more innovative and inspirational experience. By using technology, these start-ups automate tasks and save money. Mobile payments, cryptocurrency and online services are just the tip of the iceberg.

How does Fintech Help People Around the World?

Fintech is targeting Millennials because of their digital familiarity. Services directed at older generations are close to none since they do not address their needs. But people are more open to digital transactions due to business requirements and convenience.

As consumers become technology acceptive, the thriving start-ups will improve their services and bring new software solutions. Just a few years back, the financial industry was at a loss, fearing losing the clients to an alternative to traditional banking processes. At this point, they realise there is unharnessed potential in new technologies.

According to global market research companies, 60% of consumers worldwide wish to work with financial institutions that deliver a single platform such as social media or banking apps. The fast-developing growth of mobile payments affects people around the world. Primarily if we take into consideration that many nations in the world have no access to financial institutions.

“I could either watch it happen or be a part of it.” – Elon Musk.

Fintech has built a vision for people in underdeveloped regions to live better lives through reduced costs of digital payment services. Successfully expanding their financial services, Fintech companies have improved the accessibility to credit for many struggling businesses. All of which has a somewhat positive result on the economy.

Fintech is becoming a crucial opportunity in the business world. The time efficiency of online banking appeals to occupied business owners. Statista report shows that just over 70% of bank executives are collaborating with Fintech firms. It seems that the new technology concept is paving the way into traditional banking markets.

Fintechs’ are tearing down the world’s borders, making themselves present in all corners of the globe. Conventional banks are competing among themselves based on their size and market presence. With Fintech, the focus is on responsiveness and efficient addressing of user demands. More to the point, they offer niche-centered services that fill the gap in particular financial need.

Fintech Software that Actively Takes the Global Market

Apart from business, Fintech is an evolution of financial services and encompasses a wide range of trading and banking. Transactions are primarily available through mobile apps. Google Play Store has reported a 51% growth in Fintech app downloads in 2020.

As a large corporation, Google has launched its own digital wallet platform and online payment system in 2015. Their popularity across the globe is evident in statistics from January when Google Pay reached a record of 10.6 million downloads per month.

Like many other companies, Google has secured permissions to provide financial services across European Union. The platform offers safe, contactless payments and shopping with Android phones, tablets and even smart-watches.

How Many Fintech Companies are There in the World?

According to an independent study of the Tiplati company, 96% of global customers are aware of at least one fintech service or firm. Investing in the sector has dramatically progressed over the years, giving a wind in the back of new entrants. In February 2021, market research groups reported 26,045 Fintech start-ups in the world. Almost half of these are in the US, while another half is in Europe, Middle East, Africa and the Asia Pacific territories.

Which Software Companies to Choose for Fintech Software Development?

Software companies that are the best for Fintech software development are the ones that have previous experience in such a product. With this in mind, many of these companies have NDA’s and are not entitled to name their earlier portfolios. In Fintech development, there is always a silent rule that restricts sharing sensitive data with a third party.

When companies decide to develop Fintech software, they have a specific goal. Such an approach needs custom or bespoke software tailored to their needs. Software outsourcing companies such as TNation produce this kind of software. Most of our clients decided on an extended team model, which means partnering with us on software development. This partnership means that our company is a provider of:

- Fintech development solution,

- business analysis,

- resources,

- IT,

- recruitment,

- infrastructure,

- experts in Fintech.

Our engineers have technical skills and understand the complexity of the market. Their experience allows them to build a software solution that aligns with user expectations. We highly regard good communication at the beginning of the project. The TNation team of developers attends to clients’ needs and understands them in detail to deliver a final product with a competitive edge on the market. TNation has earned start-ups’ trust by providing reliable systems driven by the latest technologies.

What is the Future of Fintech Software?

Suppose one word can describe Fintech. It would be an innovation. Since its early days, the industry affected many traditional aspects of trading, banking, and products. Everything that used to be in the office has now moved to mobile devices. Digital technology is at the core of the business, a tool that changes financial services. Companies are investing in Fintech software to ensure finance management, investment decisions and serving customers.

It would seem that the industry is just at the start of the growth and innovation race. Its future seems limitless, and technology is the key to moving away from current business structures and services. Many financial technology-oriented companies are starting to use artificial intelligence (AI) to understand customer journeys better. What that means is that digital banking will undoubtedly grow in time. This concept of financial services allows the exchange of currencies alongside Bitcoin and Ethereum. The future of financial services is in agile technologies and robust data security policies.

All is Good with the World?

The digital change that the entire world experiences are somehow a consequence of global pandemics. In its wake, many organisations had ample time to evaluate their readiness for such disruptions. The fintech industry has woken up and understood the importance of digitalisation and technology. It is innovative, futuristic and focuses on user experience.

Over the last decade, an investment in the industry constantly grows from 5% to 20%. Be that as it may, there is a lingering optimism involving technology. Its success often remains memorable for generations to come. As humans, we want to see a better world and pertain to an even better place. As the Fintech industry grows, it’s hard to tell reality from an optimistic pitch.

Lately, titles in the trade media state the use of chatbots, blockchain, Robo-advisors in the financial industry. Withal, Fintech software solutions have started a revolution in how we go about our daily life. There is a definite potential for digital financial services, from providing secure, contactless and low-cost financial services to becoming a convenience amidst the crisis.

TNation, an outsourcing company, empowers the financial industry with custom Fintech software solutions that are secure, compliant and user-friendly. If you are looking for a Fintech software development company, contact us here.